Pro zkušené milovníky kasinových her nebo i pro ty, kteří s online kasiny teprve začínají, může být registrace účtu v moderním a bezpečném online kasinu velmi lákavá. Když se zaregistrujete v online kasinu, obvykle obdržíte vstupní bonus, abyste si mohli vyzkoušet některé z jeho her. Je to jeden ze způsobů, jak se s hraním v dané herně seznámit, než budete muset podstoupit velké riziko s vlastními těžce vydělanými penězi. Vstupní bonus vám poskytne čas na prozkoumání různých dostupných herních možností – od automatů a stolních her až po speciální tituly – a také vám umožní zvyknout si na rozhraní webu, takže vás hraní nebude tolik mást. Při objevování těchto nových světů můžete také narazit na několik šťastných výher! Pojďme si říct, jaké přesně bonusy dnes většina kasin nabízí a jak je nejlépe využít, abyste si byli jisti, že maximalizujete návratnost svých investic (ROI).

Bez vkladu online casino s bonusem za registraci

Pokud hledáte online herní zážitek s razancí, pak se podívejte na online kasina s bonusem za registraci – bez nutnosti vkladu! Můžete si užít všechny online kasinové hry, na které si vzpomenete, aniž byste museli předem riskovat skutečné peníze. S těmito online kasiny získáte nejen přístup k předním herním titulům a vzrušující zážitek, ale také bonus, díky kterému můžete začít hrát hned! Kromě toho tyto nabídky bonusů bez vkladu často obsahují propagační bonusy, které jsou pravidelně aktualizovány, aby hráči měli ještě více příležitostí nasbírat nějaké výhry.

Typy bonusů pro registraci v online kasinech

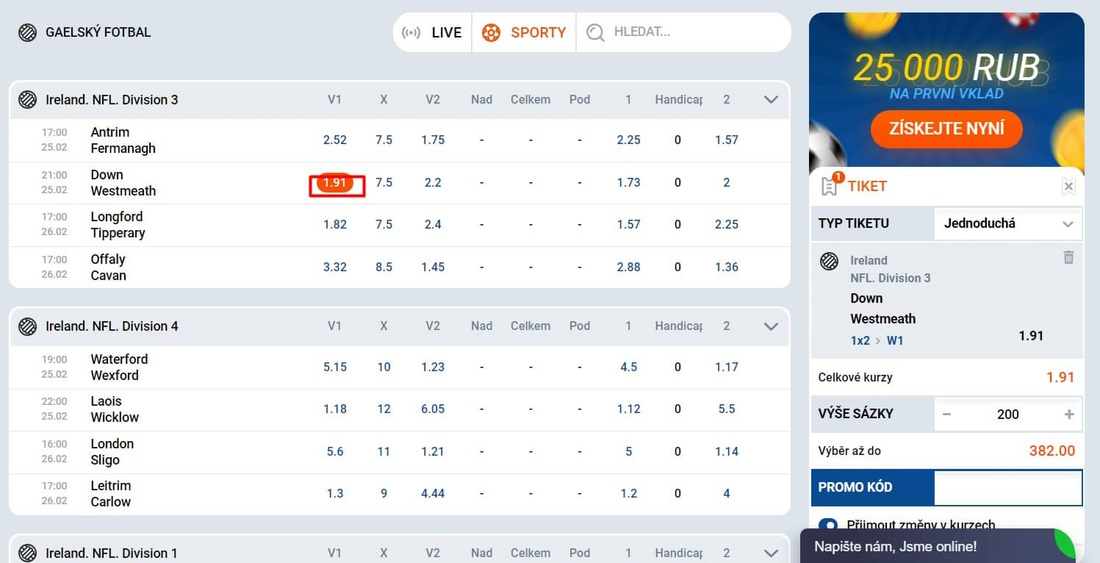

Vstup do online kasina s registračním bonusem může být vzrušující a lukrativní způsob, jak začít hrát. Mnoho online kasin nabízí různé typy vstupních bonusů, které hráčům umožňují získat nějakou výhodu za to, že se připojí k jejich online herní platformě. Typické vstupní bonusy mohou zahrnovat nabídky jako roztočení zdarma s konkrétními online hracími automaty, hotovost nebo kredity bez nutnosti vkladu po registraci nebo speciální přístup k určitým VIP případům nebo online turnajům. Bonusy jednotlivých online kasin se od sebe mohou lišit, proto je důležité porovnat několik online kasin a najít nejlepší vstupní bonus pro vaše konkrétní potřeby a preference. Ať už hledáte roztočení zdarma ve své oblíbené hře, finanční podporu, abyste mohli začít okamžitě hrát, nebo extra přístup k exkluzivním událostem a turnajům v nejlepším online kasinu – čeká na vás spousta skvělých příležitostí!

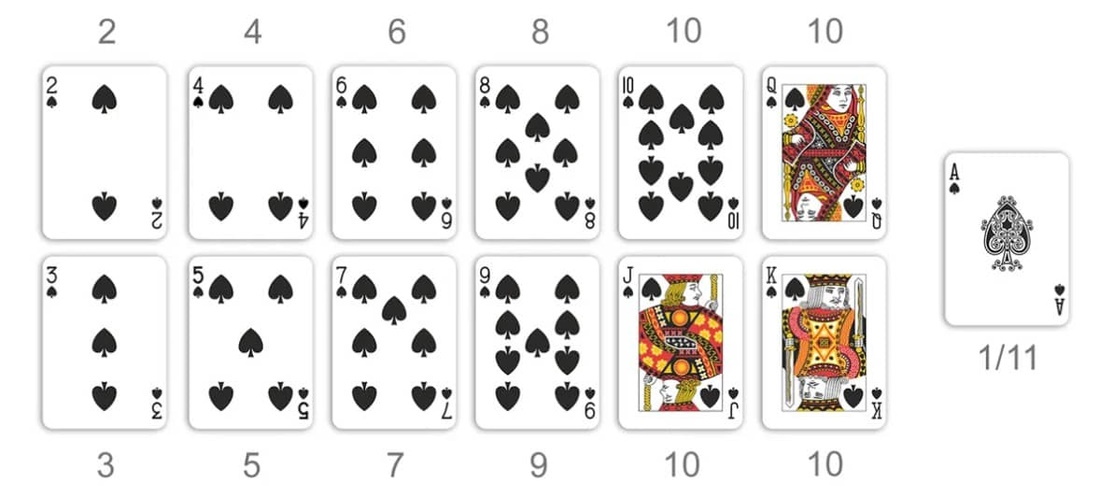

Zatočení zdarma

Hraní online kasinových her může být vzrušující zážitek a skvělý způsob, jak potenciálně dosáhnout velkých výher. Jedním z nejlepších způsobů, jak mohou hráči online kasin těchto příležitostí využít, je vyhledat kasina, která v rámci svého vstupního bonusu nabízejí roztočení zdarma. Roztočení zdarma umožňují online hráčům roztočit válce online výherních automatů bez použití vlastních peněz, čímž se zvyšují jejich šance na výhru. Pro online hráče to může být skvělý způsob, jak získat více praxe nebo nastartovat své hraní. Díky roztočením zdarma nemusí životní styl v online kasinech zruinovat banku – díky tomu má každý přístup k zábavě a vzrušení s vysokými sázkami!

Bez vkladu v hotovosti

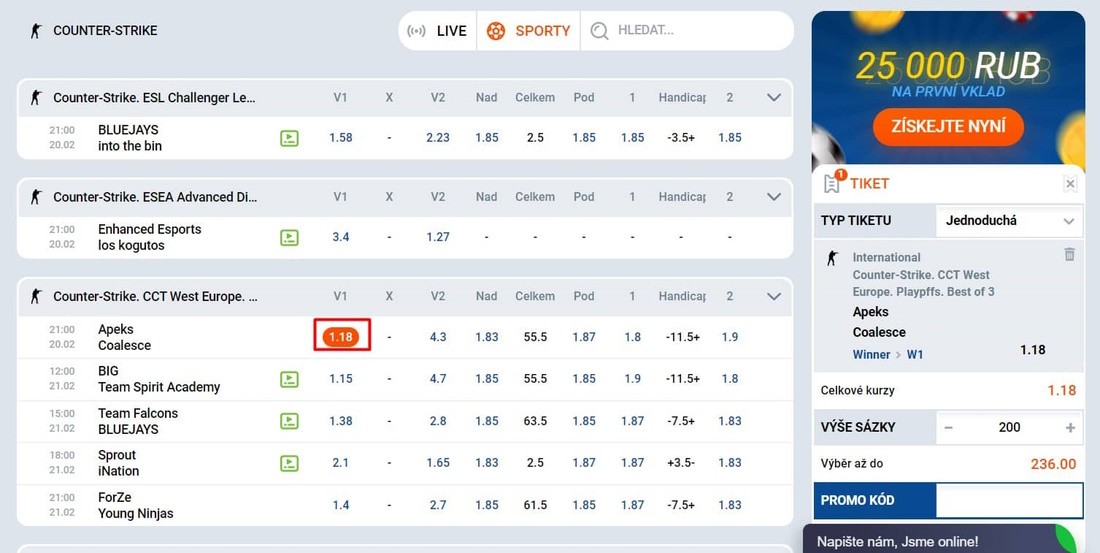

Vyzkoušení online kasin s registračními bonusy je skvělý způsob, jak zažít vzrušení a vzrušení z hraní online, aniž byste museli provést vklad v hotovosti. Kasina, která nabízejí registrační bonusy, poskytují online hráčům dodatečný bonus, obvykle ve výši jejich počátečního vkladu, což jim umožňuje vyzkoušet si hry nebo strategie, aniž by riskovali vlastní peníze. Při hledání online kasin s nabídkami vstupních bonusů je důležité přečíst si recenze od různých lidí týkající se zásad a herních zkušeností online kasina. Předem provedený průzkum vám může ušetřit mnoho bolestí hlavy, protože si zajistíte výběr spolehlivého online kasina a budete od začátku přesně vědět, do čeho jdete.

Přístup k exkluzivním akcím a turnajům

Vstup do online kasina s bonusem za registraci může uživatelům zajistit exkluzivní přístup k událostem a turnajům, kterých by se za normálních okolností nemohli zúčastnit. Nejenže online kasino dává svým hráčům možnost zažít nové turnaje, ale také jim umožňuje přístup ke speciálním jackpotům a bonusům, které mohou potenciálně vyústit v obrovské výhry. Není divu, že si hráči online kasin vybírají pro své potěšení z hraní právě tato online kasina; s jedinečnými událostmi a výhrami, které jsou k dispozici, se online hraní stává ještě více vzrušujícím.

Top 5 online casino s bonusem za registraci

Vstupní bonus je skvělý pro začátek v online kasinech, ale nezapomeňte vždy hrát zodpovědně a znát zákony o online hazardních hrách ve vaší oblasti. Užijte si dobrodružství v online kasinu s bonusem za registraci a bavte se!

Top 5 online casino s bonusem za registraci:

- Royal Vegas

- Všechny sloty Casino

- Spin Palace

- jackpot City

- 888 Casino

Každé online kasino má svůj vlastní vstupní bonus, proto si před registrací přečtěte podmínky, abyste se ujistili, že přesně rozumíte tomu, co s každou nabídkou získáte. Obecně pravidla pro bonusy online kasin zahrnují požadavek na minimální vklad a požadavky na sázení, které se mohou lišit v závislosti na podmínkách bonusu. Před uplatněním bonusu se ujistěte, že jim rozumíte, abyste nebyli zaskočeni žádnými skrytými náklady nebo poplatky.

Proč kasina rozdávají bonusy za registraci?

Online kasina nabízejí vstupní bonusy, aby nalákala nové hráče a zároveň odměnila své stávající zákazníky. Účelem bonusu je poskytnout pobídku k registraci, vkladu a hraní online her. Obecně tyto bonusy umožňují hráčům sázet s penězi z kasina a přitom mít šanci vyjít nahoru. Nabídkou štědrých bonusů jsou online kasina schopna přilákat potenciální i stávající zákazníky, kteří by jinak možná hledali herní příležitosti online jinde. Kromě toho online kasina s registračními bonusy vytvářejí příjemnější prostředí pro online hraní tím, že uživatelům poskytují strategické možnosti, které maximalizují jejich návratnost z provedených vkladů. Celkově lze říci, že online kasina využívají vstupní bonusy jako způsob, jak prospět svým výsledkům i výsledkům svých zákazníků.

Lidé se také ptají (FAQ)

Odborníci identifikují 3 hlavní typy bonusů, které kasina hráčům nabízejí:

Uvítací bonusy;

Bonusy za vklad;

Znovu načíst bonusy;

Cashbacky a bezplatná otočení pro ty, kteří nemají štěstí.

Vsazení bonusu je předpokladem pro výběr bonusových peněz a výher, které byly získány s jejich pomocí. Nedodržení tohoto požadavku bude mít za následek zrušení bonusu.

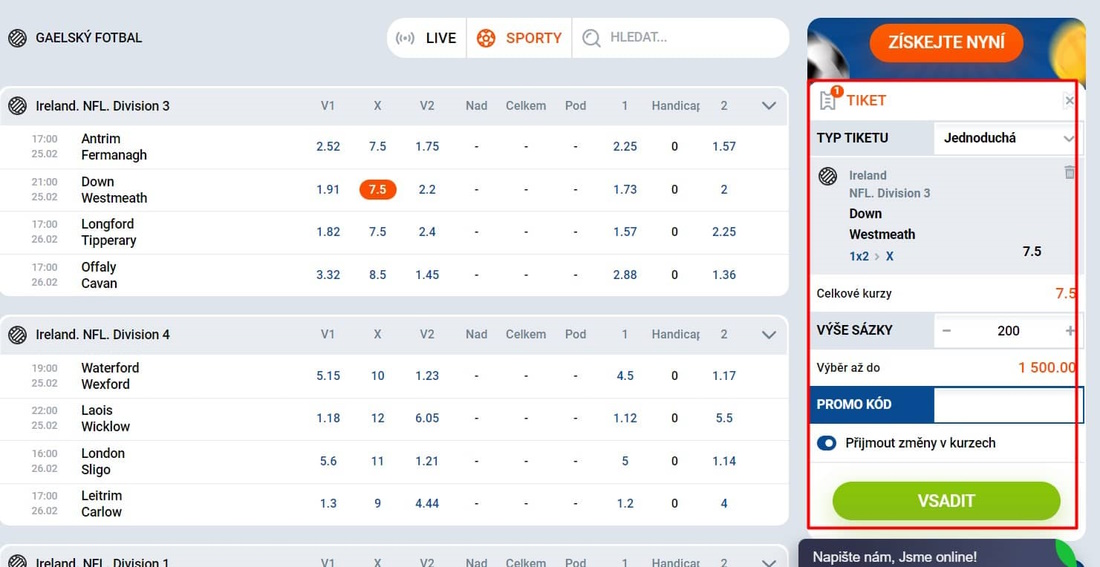

Přejděte do sekce „Pokladna“, „Platby“ nebo „Výběry“ (podle toho, co nabízí vámi vybrané online kasino). Rozhodněte se o způsobu obdržení výhry, kterému dáváte přednost. Ve speciálních polích tabulky, která se otevře, zadejte částku, kterou chcete vybrat, a podrobnosti o platbě.

Při složení sázky obdrží hráč celou částku výhry a v případě ztráty nominální hodnoty takové sázky je účet vrácen. Bonusy na bonusový účet. Hráč získává bonusové body na samostatný účet než ten hlavní. Na tyto bonusy můžete vsadit nebo je po vsazení vybrat na hlavní účet.

Využijte tedy nabídky online kasin a využijte vstupní bonusy, abyste se dostali dopředu! S trochou průzkumu můžete najít ideální kasino pro vás a začít shrabovat výhry. Hodně štěstí!

Využijte tedy nabídky online kasin a využijte vstupní bonusy, abyste se dostali dopředu! S trochou průzkumu můžete najít ideální kasino pro vás a začít shrabovat výhry. Hodně štěstí!